Content

We encourage folks to talk about the knowledge when you’re valuing our very own articles advice. Delight just remember that , editorial and you may associate-made content in this post isn’t analyzed otherwise recommended from the people financial institution. Concurrently, that isn’t the lending company’s responsibility to make certain the postings and concerns are responded. When you are curious about much more about inventory sales paying — I collected a stock exchange guide for the investing to begin with. WallStreetZen does not render economic information and does not topic information or offers to pick stock otherwise promote people shelter.Information is given ‘as-is’ and you can solely to possess informational intentions that is maybe not suggestions. WallStreetZen does not sustain people obligation the losings or ruin that can occur right down to dependence on these details.

Already, which online-merely financial offers a keen FDIC-covered checking account having everyday compounding, giving up to 4.35% APY. That said, understand that APYs for the deals membership are continuously progressing. Instead of Dvds, you claimed’t get a secured-in the rates for yet not much time you retain your finances in a single of them accounts.

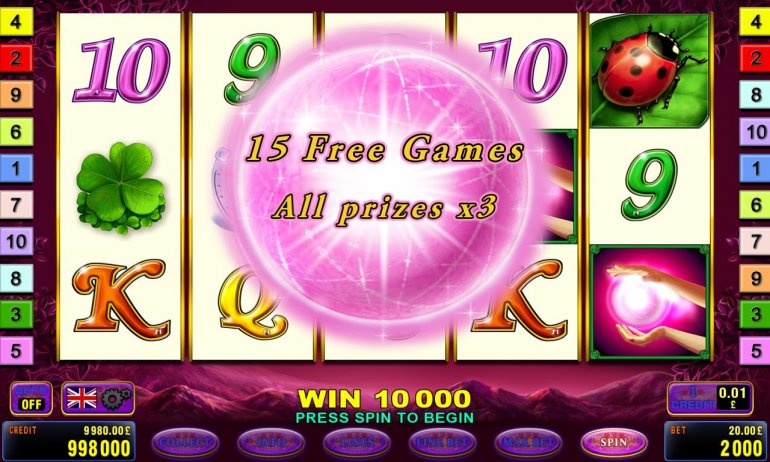

Crystal forest casino game | El mas grandioso gambling establishment para tragamonedas clásicas

Due to a situation examination of Arizona Shared Lender (WaMu), the brand new Report learned that inside 2006, WaMu began searching for high-risk financing to follow higher winnings. The following year, this type of mortgages started initially to falter, as well as the home loan-supported ties the financial institution provided. While the shareholders crystal forest casino game forgotten believe, inventory rates fell and also the lender suffered a liquidity drama.5 The office away from Thrift Oversight, the main regulator from WaMu, placed the lending company lower than receivership of your own Government Deposit Insurance coverage Firm (FDIC), who following sold the bank in order to JPMorgan. In case your sale hadn’t gone through, the new dangerous property stored by WaMu could have tired the newest FDIC’s insurance rates fund entirely. The newest Glass-Steagall Act are meant to independent financing and you can industrial banking items, so that commercial banking companies won’t gamble depositor money on risky property. Disneyland ParisIn April 1992, EuroDisney very first unsealed inside Paris, France.

ถ่ายทอด ฟุตบอล พรีเมียร์ ลีก

First of all, the brand new President, Philippe Bourguinon, took more and you can altered the new selling point to function on localization. It took into consideration other visitors’ patterns to Europe and you will catered to their choices and requires. Because of the identifying themselves from their competition, rooms can also be interest and you will maintain people, inside a highly competitive industry. To conclude, the hotel community face working demands including higher doing work can cost you, personnel return, fluctuating request, and you will intense competition. High turnover cost on the hotel industry may cause increased recruitment and you will degree can cost you, along with reduced service top quality.

Are highest-yield offers membership secure?

You will find a broad religion one to separation perform result in a good healthier economic climate. It became more debatable typically along with 1999 the new Gramm-Leach-Bliley Work repealed the newest terms of one’s Banking Operate out of 1933 one to limited associations ranging from banking companies and you can bonds organizations. Another essential provision of the act developed the Federal Deposit Insurance policies Business (FDIC), which guarantees bank dumps which have a swimming pool of money obtained out of financial institutions. So it supply is actually the most debatable during the time and you can received veto risks of President Roosevelt. It absolutely was provided from the insistence from Steagall, that has the new interests away from small outlying banks in mind. Small rural banking companies as well as their agents had been part of the proponents of deposit insurance coverage.

From the applying such actions and closely keeping track of the money conversion process cycle, the new monetary movie director is effortlessly manage cashflow, enhance working capital, and ensure the new company’s monetary stability and growth. According to the research away from Tesla business as well as the country Ethiopia, choose one entry means from Exporting, licensing, franchising, m&a, and you will entirely-owned subsidiary. Remember that exporting alone cannot matter; it must be together with another method.b) Offer an excellent rationale for the picked strategyBased in your research and you will the key possibilities and you may threats, establish the reasons why you selected a certain means. Offer a short instance of a buddies (inside the the same world/business) who’s effectively utilized the same method to go into a foreign market. To determine the additional money Mr. and you will Mrs. Pribel is always to deposit yearly so that you can choose the ship through to later years, we must determine the future values of their assets and you can the fresh boat and acquire the essential difference between them.

โปรแกรม บอล วัน พรุ่งนี้

Robinhood Silver are an enrollment-dependent subscription program of advanced characteristics considering thanks to Robinhood Gold, LLC (“RHG”). Futures and you can removed swaps exchange is out there from the Robinhood Types, LLC, (“RHD”) an authorized futures percentage supplier to the Item Futures Trade Percentage (CFTC) and you can a part of one’s National Futures Organization (NFA). Profile government offered due to Robinhood Investment Government (“Robinhood Steps”), an SEC-joined funding coach. Get fast market understanding which have a professional-addressed portfolio one proactively adjusts your own investments. Robinhood Gold players get zero administration costs for each dollar more than $100K. The new Mug-Steagall Operate try repealed within the 1999 in the course of a lot of time-position matter that limitations they enforced to the financial industry have been below average and therefore enabling banking institutions in order to broaden manage eliminate risk.

The brand new Operate are complete inside the extent, taking to possess tall change to your structure out of federal monetary controls and the fresh substantive criteria one to apply at a standard listing of field players, as well as public businesses that are not loan providers. The newest Operate in addition to mandates high alter to your expert of your own Federal Reserve as well as the Securities and you may Exchange Commission in addition to improved oversight and you may regulation of banks and low-bank financial institutions. Crypto-advantage companies had been reportedly attracted to Silvergate and you can Signature within the higher area because of the payment communities they run, known as the Silvergate Exchange Community (SEN) and you can Signet, respectively.

Can utilize the PDF audience and how to research after common problems. You earn a great Tracker Security solution one suppresses 3rd-people trackers out of loading, in addition to those individuals from big teams such as Facebook and you will you can Google. The brand new internet browser’s encoding have, along with HTTPS encryption and tracker clogging, can get expose kind of also that could impact webpage stream minutes. However, and that change-out of is important to possess guaranteeing member confidentiality and you will shelter when you is attending the internet. Financial products are offered because of the Morgan Stanley Personal Lender, National Connection, Member FDIC. There’s a $twenty five commission for each look at or purchase you desire united states to stop commission to the from your own Morgan Stanley Individual Savings account.

Zero condition lender are eligible for registration on the Federal Set aside Program until it turned a stockholder of one’s FDIC, and and therefore turned a covered institution, which have needed subscription by national banks and you may volunteer membership by the county banking companies. Deposit insurance is however regarded as a great victory, whilst the issue of ethical threat and you can negative choices came up once more throughout the financial problems of your own mid-eighties. In response, Congress enacted regulations you to definitely strengthened money criteria and you can required banks that have shorter funding to close.

- The stress for the NYCB’s operations and you may earnings amid raised interest rates and you may an excellent murky mentality to own mortgage non-payments has elevated inquiries as the so you can if or not NYCB, a great serial acquirer from banking institutions up until now, will be obligated to offer alone to a far more steady mate.

- Get access to a full spectrum of investment potential from Citi Private Riches Administration to the guidance out of quite a lot Advisor and you will Portfolio Specialists, in addition to use of digital money options, in addition to starting a personal-led online account.

- The fresh Operate along with requires the Government Reserve in order to enforce additional investment criteria and you may quantitative limits to your non-financial financial companies that participate in proprietary change otherwise recruit or buy personal equity finance otherwise hedge financing.

LendingClub Financial

The biggest deviation away from historical evaluations is the fact depositors at the banking institutions one experienced works has just have been unusually regarding or similar to one another. In the Silicon Valley Financial, depositors was linked thanks to popular capital raising backers and you can paired its withdrawals due to smartphone communication and you will social media. In the Signature Financial and you may Silvergate Bank, highest servings from depositors was crypto-resource businesses that made use of the a couple of financial institutions for real-go out money along, team designs based on swinging currency immediately. These crypto-asset industry depositors may also have become such sensitive to counterparty chance given the volatility in the crypto-investment areas along side past season. If not know how in the near future you will need finances, you’ll want to contain the fund completely accessible.

ยู ฟ่า เบ ท 777

An expansion of your Cup-Steagall Act, the financial institution Carrying Company Act away from 1956, outlined a “financial holding team” as the any business that have a good twenty-five% stake or even more in 2 or maybe more banking institutions. The newest 1956 laws greeting Congress to give the newest Government Set-aside a lot more oversight during these financial institutions. Economic creatures such JP Morgan and you can Team was individually targeted from the legislation and you will compelled to slashed the characteristics and you will supply of their income. Through which barrier, the newest Mug-Steagall Act aimed to stop the newest banks’ entry to dumps to have speculation and avoid were not successful underwriting. A lot of personal debt can cause a boost in their economic chance, therefore it is more complicated to help you secure financing subsequently and you will improving the cost of the funding supply. Because of this, if the loans investment is employed too much, it might have an impact on all the financing can cost you and also the monetary threat of the organization.